May 30, 2023

The University of Michigan’s US Consumer Sentiment gauge fell -6.8% in May to 59.2, though this is up +1.4% from a year ago. Sentiment remains well below pre-Covid levels.

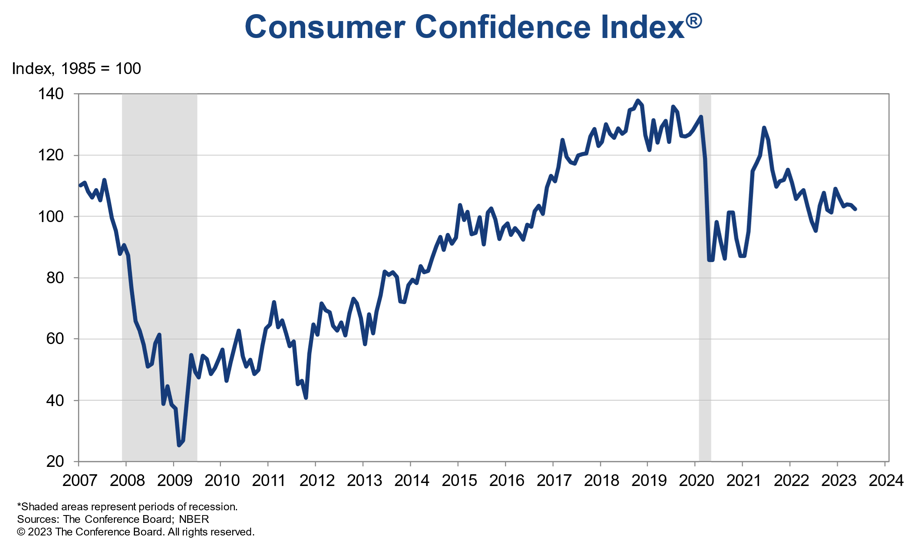

The Conference Board’s US Consumer Confidence index fell -1.4 points in May to 102.3, and remains noticeably below pre-Covid levels. “Consumer confidence declined in May as consumers’ view of current conditions became somewhat less upbeat while their expectations remained gloomy.”

In May, 19.6% of consumers surveyed by the Conference Board said business conditions were “good,” up from 19.0% in April, while 17.0%, said business conditions were “bad,” down from 18.1%. In May, 43.5% of consumers surveyed said jobs were “plentiful,” down from 47.5% in April, while 12.5% of consumers said jobs were “hard to get,” up from 10.6%.

U.S. consumer confidence, according the Conference Board survey, is being pulled down more by future expectations than by current conditions.

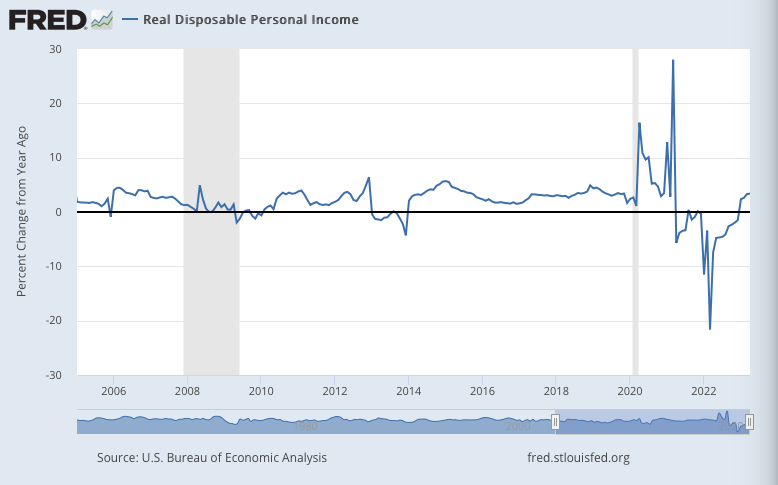

Personal incomes (not adjusted for inflation) rose +0.4% m/m in April, up +5.4% from a year ago. Taking inflation into account, real disposable personal incomes were flat m/m in April, and were up +3.4% from a year ago, back in positive territory after declining for the past two years.

Consumer spending rose +0.8% m/m in April, up +6.7% from a year ago. However, much of this gets eaten up by inflation (with PCE running at +4.4% y/y). Real spending rose +0.5% m/m in April, up a somewhat less impressive +2.3% from a year ago.

The US personal savings rate fell in April to 4.1%, thought it remains up from a near-all-time low of 2.4% in September 2022.

U.S. consumers stockpiled significant savings during Covid, though it’s unclear how evenly distributed they are across income levels.

Leave a Reply