U.S. Economic Dashboard

Here are summaries of some of the go-to data points I look to for an indication which way the U.S economy is heading. I will try to keep them regularly updated based on new data released.

Latest Economy Post

U.S. GDP – 2Q2023

July 27, 2023

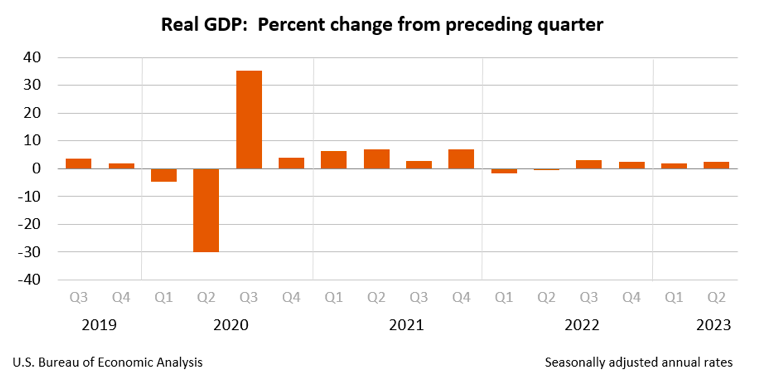

US real GDP in 2Q23 grew at an annualized q/q rate of +2.4% q/q, after inflation, higher than the 2.0% expected. This was up from +2.0% (revised upwards) in 1Q23.

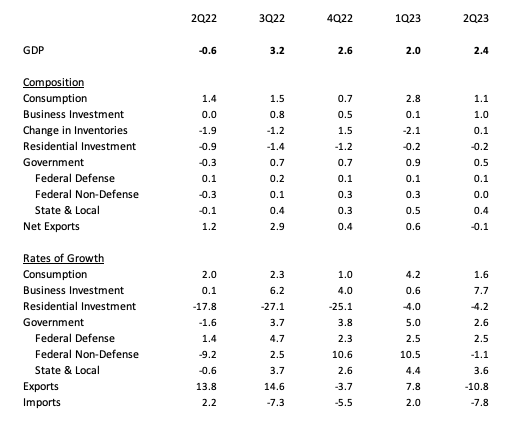

The composition of real GDP growth in 2Q23 was: +2.4% = +1.1 consumption, +1.0 business investment, +0.1 inventories, -0.2 housing, +0.5 government spending, -0.1 net exports.

In contrast, the (revised) composition of GDP growth in 1Q23 was: +2.0% = +2.8 consumption, +0.1 business investment, -2.1 inventories, -0.2 housing, +0.9 government spending, +0.6 net exports.

Consumption grew at an annualized rate of +1.6% in 2Q23, down from +4.2% in 1Q23, and contributed +1.1 points to GDP growth (down from +2.8 points in Q1).

Business investment saw a boost to +7.7% in Q2, up from a tepid 0.7% in Q1, and contributed a full +1.0 point to GDP growth, up from just +0.1 points.

Businesses also added slightly to inventories in Q2, adding +0.1 points to GDP growth, after drawing down on inventories in Q1.

Residential investment continued to decline for the 9th straight quarter, falling at a rate of-4.2% in Q2, down from -4.0% in Q1. However, the rate of decline has slowed noticeably from -27.1% in 3Q22 and -25.1% in 4Q22.

Government spending grew at a rate of +2.6% in Q2, down from +5.0% in Q1, and added half a point to GDP growth. Federal defense spending rose by +2.5% (same as last quarter), but federal non-defense spending declined -1.1% after two quarters of double-digit growth. State and local spending rose at a rate of +3.6% in Q2, down from +4.4% in Q1.

The US trade deficit expanded slightly in Q2, after four straight quarters of shrinking. As a result, GDP growth was adjusted downwards by -0.1 points. Both exports and imports fell in Q2. Exports fell -10.8%, after growing +7.8% in Q1. Imports fell by -7.8%, after growing +2.0% in Q1.

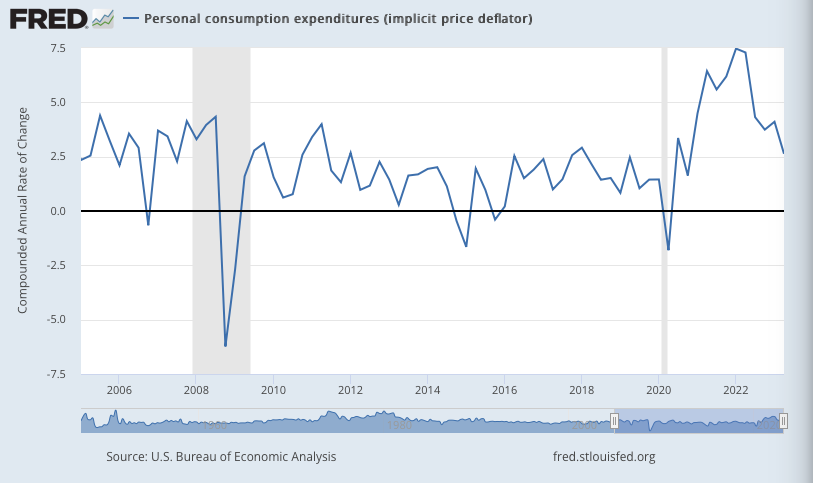

The PCE price index rose at an annualized pace of +2.6% q/q in Q2, down from +4.1% in Q1, indicating that inflation is slowing. Note that these are q/q figures giving a snapshot of current price momentum, NOT y/y rates.

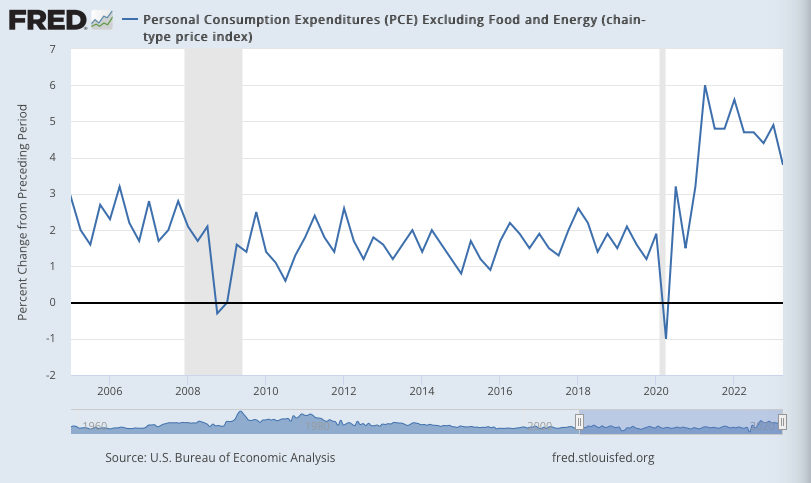

Core PCE (excluding food and energy) rose at a pace of +3.8% q/q in Q2, down from +4.9% in Q1. While inflationary pressure is declining, core inflation is proving somewhat more persistent.

As usual, the headline GDP figure conceals a lot going on under the hood. Consumption slowed, but business investment (which had been very cautious) picked up. The downturn in the housing market has eased, but has not yet seen a rebound. Foreign trade (both exports and imports) weakened, which is a concern. Inflationary pressure, however, still seems to be on a downward path.

Videos

Some of my recent appearances talking about the economy and markets.

Speaking with CNBC’s Martin Soong about the challenges of investing and doing business in China in the Xi Jinping Era. (June 2022)

Talking to CNBC’s Dan Murphy about why slower growth in early 2022 wouldn’t (and didn’t) derail the Fed’s continued rate hikes. (April 2022)

More with CNBC’s Dan Murphy, explaining the interesting historical background behind Elon Musk’s jibe about reintroducing cocaine into Coca-Cola.

Talking with CNN’s Richard Quest about the Chinese government’s crackdown on technology firms. (July 2021)

Selected Articles

Some of my previously published articles, blog posts, and other material focused on the economy and markets.

GMF: Towards a New Architecture for the International Economic Order