June 2, 2023

The following are diffusion indices, based on business surveys, which means that >50 indicates expansion and <50 indicates contraction, and 50 indicates no change. A larger or small number indicates breadth, not intensity, among survey respondents.

ISM Manufacturing Index fell -0.2 points in May to 46.9, its 7th straight month of contraction.

Although production rose +2.2 points, back into expansion territory, new orders fell -3.1 points to 42.6, suggesting continued contraction in the months ahead.

US companies responding to the ISM Manufacturing survey in May reported a very mixed picture. While “a slowdown is clear”, sales are “soft, not catastrophic.”

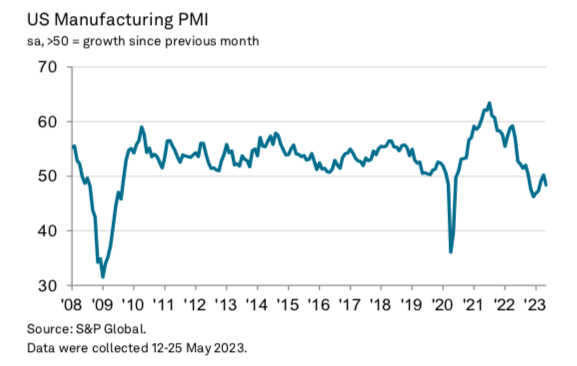

The S&P US Manufacturing PMI dropped -1.8 points in May to 48.4, back into contraction after its first expansion reading in six months.

S&P’s economists noted that the increase in production in May was due to easing supply chain constraints, which allowed companies to catch up on backlogs, but new orders slowed.

The ISM Services Index covers a broader range of the U.S. economy. It declined -1.6 points in May to a tepid 50.3 reading, barely in expansion.

Production and new orders lost momentum in May, but remained in expansion. Employment fell into contraction, and backlogs fell deeper into contraction. Price pressure eased.

Companies responding to the ISM Services survey in May reflect a very mixed picture. Some report demand slowing, others growing, others holding steady. Supply chains problems seem to have eased.

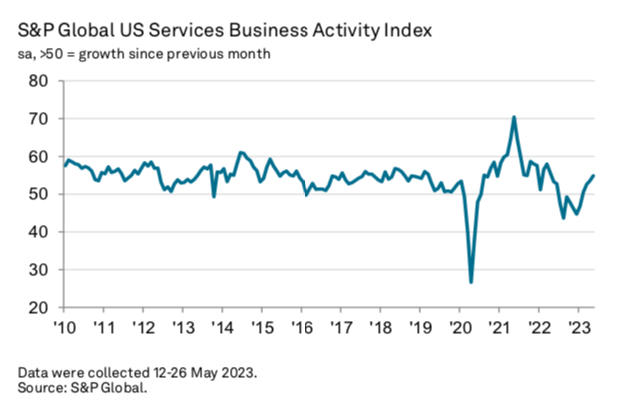

In contrast, S&P’s US Services PMI rose +1.3 points in May to 54.9, suggesting that the economy has been regaining momentum.

S&P economists say the results are consistent with 2% GDP growth and no recession this year.

Leave a Reply