July 9, 2023

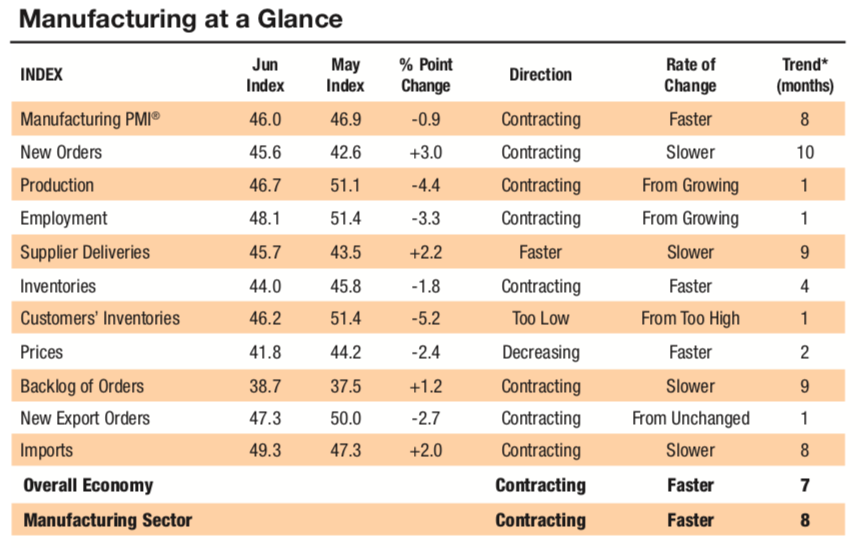

The following are diffusion indices, based on business surveys, which means that >50 indicates expansion and <50 indicates contraction, and 50 indicates no change. A larger or small number indicates breadth, not intensity, among survey respondents.

ISM Manufacturing Index fell -0.9 points in June to 46.0, its 8th straight month of contraction.

All of the sub-indices are in contraction. Production and employment both returned to contraction. Prices continue to see downward pressure, in sharp contrast to last year.

Most US companies responding to the ISM Manufacturing survey in June report slowing business along with a fall-off in inflationary price pressures.

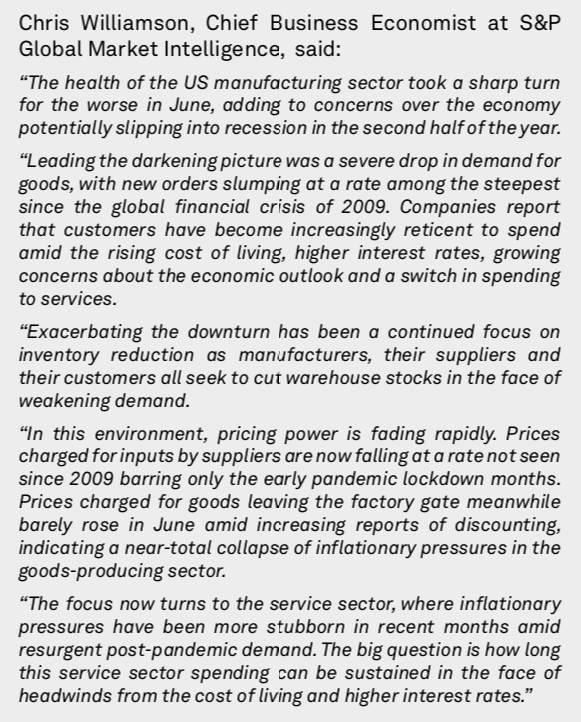

The S&P US Manufacturing PMI dropped -2.1 points in June to 46.3, its second month in contraction after momentarily stabilizing in April.

S&P’s economists noted that “the health of the US manufacturing sector took a sharp turn for the worse in June,” adding to renewed recession concerns.

The ISM Services Index covers a broader range of the U.S. economy. It rose +3.6 points in June to 53.9, in a tentative return to expansion territory.

New orders gained momentum in June, suggesting continued expansion ahead. Employment also returned to positive territory. Upwards price pressure exists, but has cooled significantly from last year.

Companies responding to the ISM Services survey in June appear to be far more optimistic than US manufacturers. They report supply chains stabilizing and business growing.

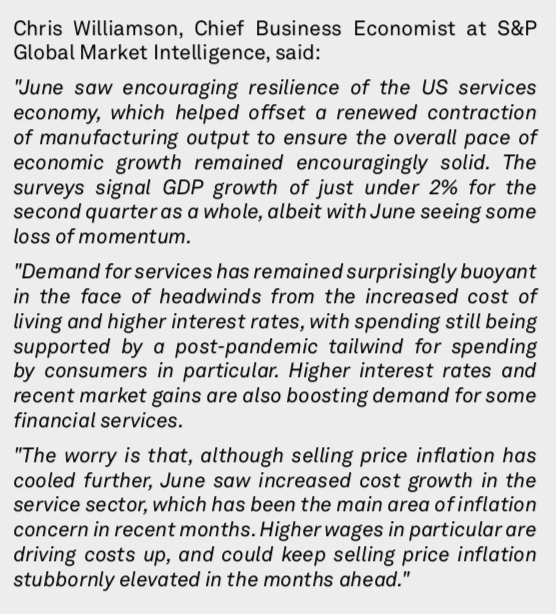

S&P’s US Services PMI fell -0.5 points in June to 54.4, but remains in expansion territory.

S&P economists note that the US services sector has remained buoyant this year, but strike warning notes about a return of upwards price pressure.

Leave a Reply